Hi, friends. I hope you’ve all been well. I took a bit of an impromptu sabbatical from the blog, but I’m back now.

When I started this blog, I meant for it to be a place where I could journal about my financial adventure. Read more about why I started this blog here. I never meant to force myself to write posts on a regular schedule if I had nothing to say. The plan was always to only post when there was something financially interesting to write about.

Here are some updates on what’s been going on in the last 9 months or so. There are 2 kind of downer sections, and 2 really good sections, so read on!

WHY I TOOK A BREAK

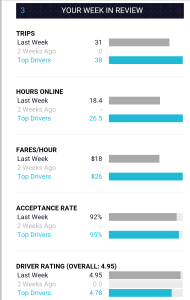

Around September of last year, I found myself in a rut. I had a new job. I had moved into a big, new apartment by myself. I started driving for Uber to pass the time. And life became very monotonous. My savings were doing well and my debt payoff was steady at about $1,000 per month.

I don’t like to throw around the word “depressed” lightly, but I guess maybe I fell into that category. I felt actively uninspired all the time. My life was dull. My work wasn’t challenging. My coworkers were mildly annoying. My boss was not doing a very good job. She was stressed and overwhelmed all the time. She was in way over her head with this role, and her stress was contagious. I felt pretty down almost every day.

THE MONEY:

I earned

$4,000

driving for Uber from mid-August to the end of the year.

THEN I GOT SOME BAD NEWS

In early December, I went to the doctor for my regular routine yearly checkup. I had no symptoms, felt totally fine. But the blood-work came back with some very strange results. My doctor referred me to several specialists, who were initially stumped, too. I’ll tell you what. When a specialist is stumped by your blood-work results and [lack of] symptoms, it’s pretty nerve-wracking.

I’ll spare you the details and I won’t leave you hanging. I’ve had blood-work done a few more times since then and everything is under control. I feel the same. They always ask me, “How are you feeling? Better?” and I have to remind them I had no symptoms before. Anyway, enough of this.

THE MONEY:

Even with stellar insurance, I spent

$480

in copays for doctor’s visits and testing.

NOW FOR SOME GOOD NEWS: MICHAEL

My husband, Michael, is still in school full-time in New Orleans. He’s graduating in December 2016 and he’s doing great. His professors love him, and even awarded him a fancy math award. I invited his parents to the ceremony and I really enjoyed celebrating this with him.

My husband, Michael, is still in school full-time in New Orleans. He’s graduating in December 2016 and he’s doing great. His professors love him, and even awarded him a fancy math award. I invited his parents to the ceremony and I really enjoyed celebrating this with him.

We started planning our summer, and he decided to apply for an internship at VW, here in NJ. He was going to spend the summer with me anyway–we figured, might as well get a job and some good references. More importantly, I wanted him to get a taste of corporate life. For as long as I can remember, he’s wanted to be a high school math teacher, but lately, seeing the work I do and the money I make, he’s been saying he might want to work in industry.

There are about 400 internships available at VW each summer for undergrad and graduate students. Thousands apply. There was only 1 listed as a Data Analytics position. Michael applied for that one and got through 3 rounds of video interviews before he found out the position had been listed incorrectly. It was not, in fact, a Data Analytics position, but a Marketing one. Having no experience in Marketing, he was skeptical, but decided to move forward with his application, while being candid about his inexperience. After his 4th interview, he got the job!

I knew there would be a high probability that he would hate it. He’s really not into being politically correct or climbing the corporate ladder. Turns out, he loves it. His coworkers are all really smart and his projects have been good, challenging uses of his skillset.

THE MONEY:

He’s earning

$22/hour, and got a $5,600 signing bonus.*

For a 10 week internship.

*Yeah. More about this later.

MORE GOOD NEWS: ME

Around March, one of my peers on the Executive Relations Analytics team took a lateral move. She got a 10% raise, which I heard was unprecedented, but her previous base was really low, so I think that’s why they were able to offer her so much. I was happy for her. Normally, lateral moves get 0-5%.

She and I talked, and she thought I would be a really good replacement for her. I like data analytics way more than what I was doing, and her position got really great exposure. I thought career-wise, it’d be great for me, plus, I’d get to do work more in line with what I enjoy. Added plus, the boss over there is super awesome. I knew we’d work well together and I’d learn a lot from her.

I interviewed, and got the job! Then… they offered me a 2% raise. With no option for overtime. And a 1-year commitment. I was crushed. In my current job, I was working tons of overtime, so even this 2% raise would have been a pay-cut if there was no overtime. I really wanted this job and really struggled with how to respond. I asked for 5%. This, too, would have been a pay-cut, but not as bad. They said they couldn’t do it. I turned it down. What I thought was my dream job… poof! Gone.

It took a lot of courage to turn the job down. I had never done that before. I thought I’d feel great after, but I didn’t. I’d wake up in the night almost daily wondering if I had done something really stupid.

I finally decided to let it go, and keep looking. In mid-May, I saw a job that looked interesting to me. Marketing Manager of Data Analytics. Okay, it sounded perfect. I applied, and emailed the hiring manager my resume. Because I was on the wireless side, and this new job was on the landline side, none of my bosses knew anyone over there to put in a good word for me.

My cute new office.

I had one phone interview, and got the job!! I couldn’t believe it. The hiring manager said he was still working with HR to put together my offer. I was nervous, but more confident about being able to turn it down if it didn’t make sense financially. I had done it once before, and I could do it again if I had to.

Because it was a promotion, I was told to expect 10% at most. Remember, when I started my current role last summer, I had already accepted less than I wanted, in exchange for opportunity for growth. Then, while Michael was accompanying me on a work trip to Indianapolis, I got the offer call. A long conference day had just ended, and I was glad to be relaxing in the hotel room. My hiring manager was so proud of himself, and what he had negotiated for me.

THE MONEY:

I was offered a

54% RAISE with a 20% bonus.*

You read that right. And… I accepted.

*More about this later.

I started the new job about a month ago, and I couldn’t be happier! Michael’s considering working at VW after he graduates in December. Meanwhile, we’re having a blast together this summer, travelling a lot, and enjoying life. All is well in my world. 🙂

How are you?